Budget 2024 LIVE Updates : Capital gain exemption limit increased to ₹1.25 lakh per year to benefit lower and middle income classes

Sneha Singh, Acting Managing Director, GFI India-“We commend the government’s continued dedication to advancing agriculture and food processing, as reflected in the latest budget. The focus on raising productivity and developing climate-resilient crop varieties, including the introduction of 109 new crop varieties, is a significant stride towards sustainable agricultural practices. We applaud the special focus on achieving self-sufficiency in pulses and oilseeds to reduce the dependence on imports and create more pathways for value-added products such as plant proteins. These initiatives will not only enhance food security but also bolster agricultural sidestreams and help localise and accelerate the alternative protein sector.

The allocation of substantial funds for skilling and employment, especially in the agri-tech and food-tech sectors, along with the skilling initiative in collaboration with State governments and Industry through ITIs is particularly relevant to plug in talent gaps for the smart protein sector’s emerging needs. Continued support for entrepreneurship, particularly through schemes benefiting MSMEs and start-ups, is a promising move that will drive growth and innovation in smart proteins, especially cultivated and fermentation-derived proteins”

“The announcement to offer internship opportunities to 1 crore students at 500 top companies over the next five years is a welcome move to foster industry-academia collaboration and produce industry-ready professionals. The decision will facilitate B Schools to forge ties with industry leaders, design a more targeted curriculum and align academic programs with existing industry trends and demands. Furthermore, the allocation of Rs 1.48 lakh crore for education, employment, and skilling, is an encouraging step. However, we expect further financial assistance from the Union Government to meet the objectives of NEP 2020 and nurture future talent in the digital era. Overall, the Union Budget 2024 embodies India’s vision of becoming a Vishwaguru by promoting a proficient workforce, driving innovation, and fostering economic growth” attributed to Dr. Prabhat Pankaj, Director, Jaipuria Institute of Management, Jaipur

Ujjwal Singh – Founding CEO, Infinity Learn by Sri Chaitanya –“The Union Budget’s emphasis on education and upskilling is a commendable initiative. The allocation of Rs 1.48 lakh crore for education, employment, and skilling marks a significant step towards India’s economic growth, particularly as we advance towards digital literacy. As Finance Minister Nirmala Sitharaman stated during today’s budget announcement, this focus on education aims to enhance the accessibility and affordability of quality education. Furthermore, the budget’s emphasis on employment generation will fuel the aspirations of countless teachers, who are the backbone of our education sector. This investment will empower educators with greater opportunities to ensure ‘Baccha Seekha Ki Nahi’.

The establishment of new medical colleges in Bihar is especially encouraging for us, as we have been deeply committed to empowering learning outcomes in Bihar through our Patna Test Prep Centres. This is evident from our learners’ exceptional performance in recent competitive exams for engineering and medical fields. This motivates us to redouble our efforts to nurture outstanding doctors and improve the healthcare infrastructure in Bihar.”

“The budget announcement has laid a strong foundation for advancing education, skilling, and employment opportunities and is truly commendable. The allocation of Rs 2 lakh crore for the five employment and skilling schemes, along with Rs 1.48 lakh crore for education, employment, and skilling, underscores the government’s dedication to the country’s youth and its commitment to propel growth. The new centrally sponsored scheme aimed at skilling 20 lakh youth over five years will significantly contribute to fostering a skilled workforce. This significant step is the need of the hour to bridge the gap between education and the skills essential to equip the youth to be industry-ready. These initiatives will help us maximize our education and skilling efforts, propelling the next phase of growth for the Indian economy.–To be attributed to Mr. Pankaj Jathar, Chief Executive Officer, NIIT Ltd.

“Today’s budget announcement is a welcome move that promises to strengthen India’s position as a global hub for spiritual tourism. The continued investment in developing corridors will create a multiplier effect, stimulating the local economy and generating job opportunities. This initiative will add to the momentum that the industry gained from the Ayodhya boom earlier this year.

In the first half of 2024, Cleartrip has registered a double-digit increase in searches on a month-on-month basis for destinations such as Varanasi, Tirupati, Bhubaneswar, Bodh Gaya, Amritsar and Ajmer.

The enhanced focus on infrastructure and road connectivity will make travel, especially road transportation, more accessible and affordable. These initiatives will further bolster India’s status as a premier travel destination facilitating economic growth.” – Anuj Rathi, Chief Business and Growth Officer, Cleartrip.

Mr Pravin Patel Chairman, HOF Group-The government has come up with a finely balanced budget that focuses on all segments of society. There is a special focus on skill development and job creation. The finance minister has outlined a clear roadmap to facilitate higher participation of women in the workforce. This budget also prioritises MSMEs and manufacturing, particularly labour-intensive sectors, with initiatives such as credit guarantee scheme for MSMEs in manufacturing and new assessment model for MSME credit. The allocation of Rs. 11.11 lakh crore for infrastructure development is poised to make a significant impact and showcase the government’s commitment to build world-class infrastructure. The focus on developing cities as growth hubs will further boost growth in urban areas. The budget has rationalised the income tax structure, providing some relief to salaried taxpayers.

Mr. Aayushman Jain, Director, Siddha Group-The government’s interest subsidy scheme for urban housing is a positive step towards making home ownership more accessible. The PM Awaas Yojana-Urban aims to meet the housing needs of one crore poor and middle-class families through an investment of Rs 10 lakh crore, including Rs 2.2 lakh crore in central assistance over five years. This initiative will boost the real estate market and stimulate demand for affordable housing.

The central government will be proposing a lowering of stamp duty rates especially for women owners, this is a great initiative for the Real estate market.

Additionally, the proposal to provide rental housing for industrial workers through PPP mode with Viability Gap Funding support is a strategic move. It addresses the housing needs of industrial workers and encourages private sector participation.

Overall, these budget measures will foster growth in the real estate sector, promote inclusivity, and ensure housing for all.

————————————————————————————————————————————————————————————————————–

Mr Sahil Saharia, CEO, Bengal Shristi Infrastructure Development Ltd.

“The government’s new interest subsidy scheme and additional funding for affordable housing mark a substantial move towards tackling urban housing issues. The ₹10 lakh crore investment under PM Awas Yojana-Urban, set to aid one crore families, alongside the ₹2.2 lakh crore central assistance over the next five years, is a commendable effort. Furthermore, promoting rental housing for industrial workers via PPP mode with Viability Gap Funding support will enhance housing accessibility and affordability.”

————————————————————————————————————————————————————————————————————————————–

Mr Rishi Jain, Managing Director, Jain Group

The Budget 2024 has been crafted in alignment with long-term goals of the Central Government as is the style in the previous 6 budgets too.

It is obvious the Government is aware of the massive profits that Stock Market investors have made in the past 4-6 quarters and now it wants its share of profit when these investors cash out their gains. The introduction of specific fiscal measures to capture a portion of these profits is a prudent move, ensuring that the benefits of economic growth are equitably shared and reinvested into the nation’s development. The extra STT and investment gain income will obviously be offset to provide sops and relief to the salaried class through lower tax rates and higher standard deductions. A clear populist measure, but after the 2024 elections debacle, this was not unexpected.

I feel the populist measures will be far outweighed by the long terms benefits. The slight pinch to investors will be outweighed by the burgeoning India prosperity. The general populace will be somewhat satisfied while fostering economic inclusivity and stability.

The government demonstrates its commitment to a balanced and forward-thinking economic strategy.

I am personally very happy with the thrust on affordable housing, developing the transport infrastructure as well as the Human Capital which has been proposed. Achieving even 50% of these lofty goals would greatly boost the India Story in the world markets.

———————————————————————————————————————————————————————————————————————————————-

Recycling Sector

Post Budget views of Mr Nandan Mall Founder & CMD, Hulladek Recycling Pvt Ltd.

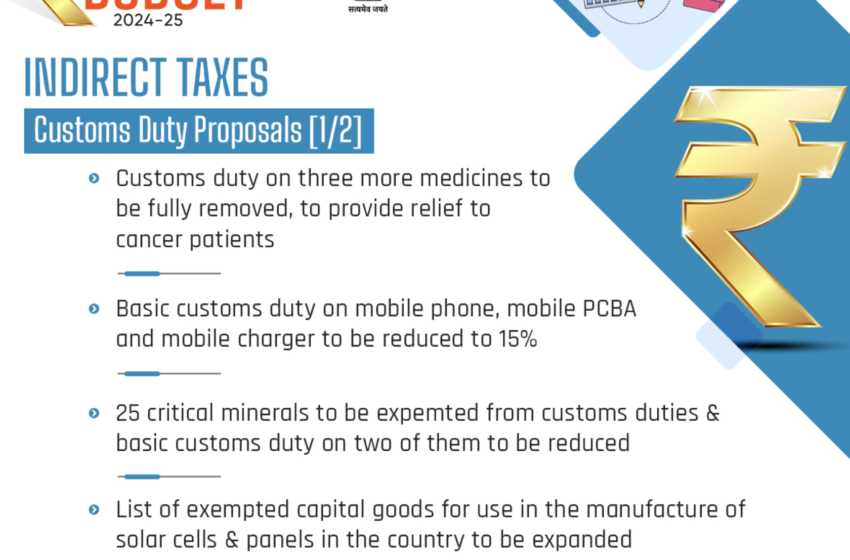

– Exempting custom duties on critical minerals will boost the recycling industry, inviting more entrepreneurs to invest and venture into the recycling industry

– Setting up of a Critical Mineral Mission is a landmark decision which will help procuring precious metals and minerals from recycling of electronic waste

– Availability of finance in the climate sector will boost businesses and encourage new entries

– As a youth driven organisation, we are happy to see the inclusion of paid internship opportunities to 1 crore youth in 5 years. Internship allowance of 5000 per month along with bonus on 6000 will be provided by the government. 10% of internship cost can be borne from the CSR funds.

—————————————————————————————————————————————————————————————————————————————————————

Healthcare

Mr Debashis Dhar, Senior Vice President & Chief Business Development, ILS Hospitals.

“Tertiary care services are significantly lacking in Tier-3 cities compared to Tier-1 cities. There is a pressing need to vigorously promote preventive healthcare. Public-private partnerships (PPP) are crucial for setting up quality healthcare facilities. Moreover, the salaried class expected greater tax relief, which was not sufficiently addressed. Exempting certain additional medicines from customs duties to support cancer patients is a commendable initiative.”

—————————————————————————————————————————————————————————————————————————————————————–

Education

Prof. Manoshi Roychowdhury, Co-Chairperson, Techno India Group

The Union Budget’s Rs. 1.48 lakh crore allocation for education, employment, and skill development is a major boost for India’s youth and workforce. This focus complements Techno India Group’s mission to provide quality education , encourage skill development and innovation.

The continued implementation of schemes from the Interim Budget, coupled with this renewed financial support, strengthens our efforts to build a strong educational ecosystem.India’s stable economic growth and inflation create a favorable environment for educational and economic reforms.

Gaurav Aggarwal, CEO of Savaari Car Rentals, expressed, “The interim budget of February 2024 laid down a promising path, significantly increasing the budgetary allocation for the tourism ministry. This strategic move underscores the government’s commitment to enhancing tourism infrastructure, which is crucial for invigorating local economies and attracting both domestic and international tourists.

“The latest budget builds on these efforts by emphasizing key areas of infrastructure development. Investments in expanding and modernizing highways, improving road connectivity to popular and offbeat destinations, and enhancing airport facilities are pivotal steps. These improvements not only make travel more convenient and enjoyable for tourists but also play a vital role in boosting regional economies and creating jobs.

“Furthermore, the focus on sustainable and eco-friendly infrastructure projects is commendable. Initiatives such as promoting electric vehicle usage, developing eco-tourism spots, and preserving cultural heritage sites reflect a forward-thinking approach. Although there were some reductions in the overseas promotion budget, the long-term benefits of robust infrastructure and connectivity are expected to far outweigh these cuts,” he remarked.

“The Union Budget 2024 is a visionary blueprint for India’s progress. Focusing on affordable housing, urban development, and domestic manufacturing, the government has laid a strong foundation for sustained economic growth and improved quality of life. We applaud the government’s visionary approach to better the infrastructure and support affordable housing. In line with these initiatives, the housing market is set to gain further momentum, providing opportunities to companies, and fueling growth across the building and construction industry. We believe that these steps will aid a thriving ecosystem for the building and construction industry.”- Sudhanshu Pokhriyal, Chief Executive Officer, Bath & Tiles Business, Hindware Limited.

Mr Yatin Gupte, Chairman & Managing Director, Wardwizard Innovations & Mobility Ltd, said, “We at Wardwizard Mobility welcome the Government’s progressive and forward-thinking Union Budget 2024-25. The commitment to maintaining strong fiscal support for infrastructure projects over the next five years is a significant boost for the automotive sector. The announcement to fully exempt customs duty on critical materials, such as rare earth metals including lithium, can further incentivize electric mobility. We are looking forward to receiving the benefit of this exemption along with the sectors mentioned by the Hon’ble Finance Minister. The focus on increasing women’s participation in the workforce will also benefit the sector. The Union Budget 2024-25 presents tremendous growth opportunities for all sectors, and Wardwizard Mobility is committed to contributing to India’s journey toward a cleaner, more inclusive, and sustainable future.”

Jaya Mehrotra, Founder, Women Leadership Circle, Leadership & Executive Coach; I applaud the decision to prioritize employment, skilling, and MSMEs. Setting up hostels and forging partnerships for women-specific skilling programs are pivotal steps in dismantling barriers and fostering inclusive growth.

This budget not only reflects a forward-thinking approach but also a profound understanding of the structural changes needed to empower women. By investing in these initiatives, we are paving the way for a more equitable and dynamic workforce, where every woman has the opportunity to thrive and lead. As part of an organisation working towards empowering women in the workforce, I am eager to collaborate on these transformative efforts and support the realization of this vision.

Avneet Singh Marwah, CEO of SPPL, Exclusive brand licensee of Blaupunkt TVs in India

The Union Budget 2024 demonstrates a strong commitment to job creation in the manufacturing sector. By providing targeted incentives for EPFO contributions, the government aims to generate significant employment opportunities for both employers and the 30 lakh young people entering the workforce. This initiative reflects a strategic approach to meeting employment needs in our rapidly evolving economy.

With a substantial allocation of INR 2 lakh crore towards skilling programs, the budget emphasizes equipping our workforce with the skills necessary to succeed in a competitive global market. The focus on Micro, Small, and Medium Enterprises (MSMEs) is further supported by the introduction of a credit guarantee scheme, designed to enhance the financial stability and growth potential of the vital enterprises.

Additionally, the budget’s focus on the middle class is evident through tax relief measures, such as an increase in the standard deduction for salaried individuals and additional benefits under the new tax regime. These measures aim to boost disposable income and stimulate consumer spending, thereby fostering economic growth.

In summary, the Union Budget 2024’s initiatives in the manufacturing sector represent a forward-thinking strategy to create sustainable jobs, enhance skills, and support MSMEs. These measures are poised to play a crucial role in empowering our youth, strengthening the middle class, and guiding the nation towards a prosperous future.

—

Prerna Kalra, Co-founder and CEO Daalchini Technologies

The Union Budget 2024 marks a significant and encouraging shift towards inclusive and equitable growth. The budget’s emphasis on job creation through EPFO contribution incentives promises to generate opportunities for 50 lakh youth, including a substantial number of women. This is a pivotal moment, opening doors for greater female participation and advancement in the workforce.

A new centrally sponsored scheme to skill 20 lakh youth over the next five years, coupled with the upgrade of 1,000 ITIs to offer industry-relevant courses, will prepare a workforce ready for emerging sectors. This initiative is particularly valuable for women seeking to acquire new skills and excel in various fields.

Moreover, the facilitation of term loans for machinery purchases is a welcome development for entrepreneurs. This support will help scale up operations, invest in innovative technologies, and boost productivity, driving growth and success for businesses.

The allocation of over 3 lakh crore for schemes benefiting women and girls is especially inspiring. It highlights a robust commitment to supporting women entrepreneurs and addressing their needs across various sectors. This investment in women’s empowerment will foster entrepreneurship and contribute to broader socio-economic development.

Overall, the Union Budget 2024 reflects a progressive vision for India, emphasizing job creation, skill development, and inclusive growth.

—

Ratan Singh Sehgal, MD, Hybon elevators & escalators Pvt Ltd.

The budget’s focus on developing cities as ‘Growth Hubs’ through economic and transit planning is an important initiative. By partnering with states and implementing town planning schemes, this approach aims to upgrade urban infrastructure and stimulate economic development at the micro level. The expansion of the tourism corridor will benefit the hotels and restaurant industry. Increased construction of hotels, motels, and tourism spots will expand global footprints and stimulate local economies. This will lead to job creation and attract investments from corporates into these states. The government has also planned to invest ₹26,000 crore in Bihar, which will also see improvements in infrastructure such as airports and highways.

Job creation and manufacturing in Tier 3 and 4 cities will attract and retain local talent, fostering economic growth and development. The government’s plan to invest in these regions, including the Amritsar Kolkata Industrial Corridor and the development of an industrial node at Gaya, aims to generate economic opportunities and contribute to the vision of Viksit Bharat. Infrastructure development at the micro level will enhance connectivity and create a conducive environment for businesses to thrive, further driving economic activity and job creation.

Union Budget 2024 represents an approach to addressing India’s urban housing needs and supporting economic growth. The allocation of ₹10 lakh crore for Urban 2.0 is notable, with plans to construct 1 crore (10 million) houses for the urban poor, alongside an additional 3 crore houses under the Pradhan Mantri Awas Yojana (PMAY). This commitment will improve living conditions across both rural and urban areas, reflecting the government’s dedication to enhancing housing accessibility and quality.

In the manufacturing sector, the introduction of the Credit Guarantee Scheme for MSMEs, a new assessment model for MSME credit, and the enhanced limit for Mudra Loans under the ‘Tarun’ category are significant measures. These initiatives will provide support to small and medium enterprises, facilitate job creation, and strengthen the economic foundation. Additionally, Scheme B, which offers incentives for EPFO contributions for first-time employees and employers for the first four years, is expected to benefit 30 lakh youth, further boosting employment.

Overall, the Union Budget 2024 sets a path towards a prosperous and inclusive future for India, with targeted investments and strategic initiatives aimed at enhancing economic opportunities across the country.

Mr. Vidur Varma, CEO of Agri Wings

“We commend the Union Budget presented by Finance Minister Nirmala Sitharaman for its comprehensive focus on empowering farmers and enhancing the agricultural sector. The emphasis on increasing MSP for all major crops and prioritizing productivity and resilience in agriculture is a significant step towards securing farmers’ livelihoods. The introduction of 109 climate-resilient crop varieties and the mission for self-sufficiency in pulses and oilseeds will greatly benefit farmers.

The initiative to engage one crore farmers in natural farming over the next two years, supported by branding and certification, is a visionary move that aligns with sustainable farming practices. Additionally, the development of large vegetable production clusters and the promotion of farmer producer centers, cooperatives, and startups will strengthen the supply chain and boost rural economies.

With a substantial allocation of ₹1.52 lakh crore for agriculture and allied sectors, this budget sets a strong foundation for achieving ‘Viksit Bharat’ by 2047. We look forward to contributing to this mission by integrating advanced drone technologies and efficient farming practices, ensuring a prosperous future for our farmers.”

Post Budget by Harshad Patwardhan, Chief Investment Officer at Union Asset Management Company Private Limited

“The biggest positive from this budget is the government’s reaffirmation that it is committed to its fiscal consolidation plan despite perceived pressures from the coalition partners. It is heartening to see that the government has not diluted its focus on capital expenditure for infrastructure creation. It has, however, brought some rebalancing to its supply side focus with more attention to boost consumption by creating incentives from employment generation and easing credit availability to MSMEs. We believe the time is now ripe for the private sector to pick up the mantle to undertake capital investment to boost growth. While increase in capital market taxation is a bit disappointing, on balance, the budget is expected to prove positive for equity markets from medium to long term perspective.”

Sanjeev Dasgupta, CEO of CapitaLand Investment India

The government’s commitment to establish ‘plug and play’ industrial parks and ‘Cities as Growth Hubs’ will unlock significant investment opportunities and drive demand for modern commercial spaces in the country. With added benefits, this move will also incentivize global firms to strengthen their manufacturing hubs in India.

Additionally, the proposed ‘Transit Oriented Development’ will be a promising step towards decongesting cities, and creating a vibrant landscape for investment. Faster implementation, with a focus on regions such as Bangalore, Mumbai and NCR will be imperative to sustain and accelerate the pace of industrial development and new workforce integration.

Mr. Amit Kapoor, Founder and CEO, Eupheus Learning “The FM’s Budget for 2024-25, and the allocation towards education, employment, and skilling, is noteworthy. The focus on skilling the youth with the industry needs and providing education loans with an attractive subvention scheme is a game-changer.

At Eupheus Learning, we believe that identifying the right skills should happen inside classrooms in schools. An enabling environment of in-classroom and at-home learning ensures that our young learners get the infrastructure and support needed by them to work towards their respective aspirations. These measures from the government are a good step forward and we are sure that there will be percolation down to the school level in each district. This percolation will equip students with the skills they need to excel in their careers and contribute to the economy.”

“Energy security and infrastructure have been highlighted as top priorities in the budget proposal by the Hon’ble Finance Minister. Alongside the allocation of INR 11 lakh crore for capital expenditure, the government has pledged to maintain strong fiscal support for infrastructure investment. The provision of INR 1.5 lakh crore for long-term interest-free loans to states for infrastructure development is a positive announcement that will significantly boost state-level projects. It is encouraging to see the government promoting niche areas in the renewable energy ecosystem, such as pumped storage hydro projects and modular nuclear reactors. Moreover, the commitments to enhance private investment in the sector through viability gap funding, enabling policies and regulations, and a market-based financing framework will attract private capital and stimulate business growth within the domestic market. A big thumbs-up to this futuristic budget!” – Amit Uplenchwar, Director, Kalpataru Projects International Ltd.

“The 2024 Union Budget outlines a strategy for achieving nine key priorities and aims to create opportunities for youth, farmers, and the rural population, pushing India closer to the vision of Viksit Bharat. The Finance Minister’s commitment to agricultural reforms with measures like bringing 6 crore farmers into the farmer and land registries, establishment of bio-research centers and expansion of Kisan credit cards , backed by a significant Rs.1.52 lakh crore spend, will definitely boost the sector’s growth. Despite being the second largest producer of fruits and vegetables, India accounts for merely 2% of global horticulture trade. The FM’s announcement to set up large scale clusters for vegetable production and utilization of FPO’s and start-ups to promote vegetable supply chains will not only help control food prices but set the stage for making India a major horticulture exporter. Similarly, focus on climate resilient crops and access to new technology will bring in food security as well as Atmanirbharta in key areas like oilseeds.”

- Mr. Simon Wiebusch, President of Bayer South Asia and Vice Chairman, MD & CEO of Bayer CropScience Ltd (BCSL)

Anish Bafna, CEO and MD, Healthium Medtech.

“The Union Budget 2024-25 sets the foundation for our nation’s unrelenting pursuit towards Viksit Bharat 2047. The announced exemption of custom duties on the three additional cancer formulations is an industry welcoming move towards patient centricity, easing the financial and socio-economic burden of the disease on patients. Additionally, the detailed changes in basic custom duties on medical equipments like X-rays and flat panel detectors under the government’s phased manufacturing program will go a long way to bolster the domestic production capacity for local players. Such interventions from the government will propel conducive policymaking and enhance affordability and accessibility in healthcare, while supporting manufacturing and innovation in the medical sector.

The increased impetus on job creation and central skilling programs will boost productivity and excellence in the workforce for developing sectors like manufacturing and MSMEs. Tailored initiatives like Anusandhan National Research Fund for powering innovation, research and prototype development, will encourage the spirit of self-reliance, promote talent and generate indigenous solutions in healthcare. The financial outlay of ₹1 Lakh Crore will further spur private sector-driven research and innovation at a commercial scale. Moreover, the ₹1,000 crore fund announced to boost India’s space economy will encourage private innovation, advance our Atmanirbharta initiatives and benefit 180+ startups, and more incubated applications.”Abhishek Teri – Co-Founder, Underrated Club (MSME and Retail)

Today’s Indian budget announcement has brought a mix of optimism and cautious anticipation for the textile industry. The government’s decision to allocate additional funds for technological advancements and skill development is a welcome move, poised to enhance productivity and global competitiveness. The emphasis on improving infrastructure and logistics will undoubtedly benefit the sector by reducing operational costs and improving supply chain efficiency.

However, the industry had higher expectations for more substantial tax reliefs and incentives, especially in light of rising raw material costs and global market pressures. While the budget does provide a solid foundation for growth, it falls short in addressing some of the immediate financial concerns of textile manufacturers. Continuous engagement with industry stakeholders will be crucial to ensure that the sector can fully leverage these initiatives and navigate the challenges ahead effectively.

2.

Abhishek Sinha – Co-founder, GoodDot (FMCG and MSME sector)

The budget is a progressive one with a focus on agriculture, employment & skilling, manufacturing and services, and infrastructure amongst others. The above focus will help improve the standard of living of the masses and also help in faster and inclusive development and the country.

The allocation of 2.66 lakh crore for rural development and rural infrastructure will positively impact the lives of millions of rural population. This will also help in arresting the growth rate of rural-to-urban migration. 2 lakh crore has been allocated to employ over 4.1 crore youth over the next 5 years. This is a much-needed step for India to gain from its demographic dividend.

The abolishment of the Angel Tax on all classes of investors in startups is a welcome step and will incentivise investors to fund the Indian startup ecosystem, which stands to gain significantly in the days ahead. Of course, a special package for the plant-based industry would have been welcome considering the critical advantages the space offers in the field of health, agricultural exports and sustainability.

Overall the focus of the budget on promoting the economy in all sectors with a focus on Agriculture and manufacturing is a welcome step to democratise prosperity in India.

3. Rashmi Ghatge – Director, ParamYoga (MSME Sector)

The Union Budget 2024 presents a progressive and comprehensive approach to fostering economic growth, employment, and social welfare. The increase in the standard deduction and revised tax rate structure in the new tax regime provides significant relief to salaried employees, with potential savings of up to Rs 17,500. The focus on corporate tax reductions, particularly for foreign companies, along with simplified FDI rules, is expected to bolster foreign investments and drive economic expansion.

The government’s emphasis on MSMEs, with enhanced Mudra loans and a special credit guarantee scheme, demonstrates a commitment to nurturing small businesses and boosting manufacturing. The allocation of Rs 2.66 lakh crore for rural development, along with the launch of Phase 4 of the PM Gram Sadak Yojana and the construction of three crore additional houses under the PM Awas Yojana, highlights a strong focus on rural infrastructure and housing.

The introduction of employment-linked skilling schemes and internships in top companies for one crore youth over five years underscores the government’s dedication to addressing unemployment and enhancing skill development. Furthermore, the special financial support for flood-impacted states and comprehensive development plans for key tourist and cultural sites signify a balanced approach to regional development and heritage conservation.

The reduction in customs duties on essential goods and components, along with the exemption of certain cancer treatment medicines from customs duty, reflects the government’s sensitivity to public welfare and healthcare needs. Overall, the Union Budget 2024 aims to create a robust foundation for sustainable growth, inclusive development, and improved quality of life for all citizens.

4. Karanveer Dureja – Business Director, Banjaaran Studio (D2C, Retail & MSME Sector)

As someone closely involved with Banjaaran Studio, a D2C brand with in-house manufacturing, I believe the Union Budget 2024 will have a substantial impact on us and other MSME businesses. Here’s my take from both perspectives: as a footwear manufacturer and as an online D2C brand.

Footwear Manufacturing:

I find the Union Budget 2024 quite favorable for the footwear manufacturing industry. The reduction in the corporate tax rate for foreign companies could attract more investment, and the enhanced credit schemes and technology support will assist small manufacturers in upgrading their operations. Additionally, improved infrastructure and lower customs duties on key materials are beneficial.

Online D2C Business:

For online businesses, the budget is promising. The increased Mudra loan limit and credit guarantees will alleviate financial pressures and support growth. Skilling programs and employment incentives should help address talent shortages. The development of digital infrastructure and reduced customs duties will streamline operations and reduce costs.

Overall, these measures are creating a positive environment for Banjaaran Studio and other MSMEs, aiding in our growth and operational efficiency. The government has laid out some fantastic plans, but it will be interesting to see how many are implemented. I’m hopeful for a brighter future where small businesses like ours, along with our proud nation and the people of India, can truly thrive.

5.

Tushar Parihar – Founder, Kaner Bagh – A Heritage Boutique Hotel (Hospitality, Travel and MSME Sector)The Union Budget 2024 shows a strong commitment to improving the hospitality and tourism industry. The increased allocation towards infrastructure development, particularly in enhancing connectivity and improving tourist destinations, is a significant step forward. These measures will not only boost domestic and international tourism but will also foster economic growth and create employment opportunities. I am optimistic that these initiatives will accelerate the recovery of the hospitality and tourism industry and support long-term growth.